Table Of Content

The U.S. is providing more of the Army Tactical Missile System, known as ATACMS, in the new military package, according to one official who was not authorized to comment and spoke on the condition of anonymity. While in Rwanda, migrants who obtain legal status — presumably to enter Britain — will also be processed, authorities have said, though it’s unclear what that means exactly. Once the design has been designated as a CHP, a building permit application can be submitted to use the CHP on a specific property. With each submittal, the building code review fees will be billed at a reduction of 50 percent. Certified plans can help save on design and engineering costs as they eliminate the need to create custom blueprints for each new home. The NSFR and New Detached ADU permit application will be changing on April 25!

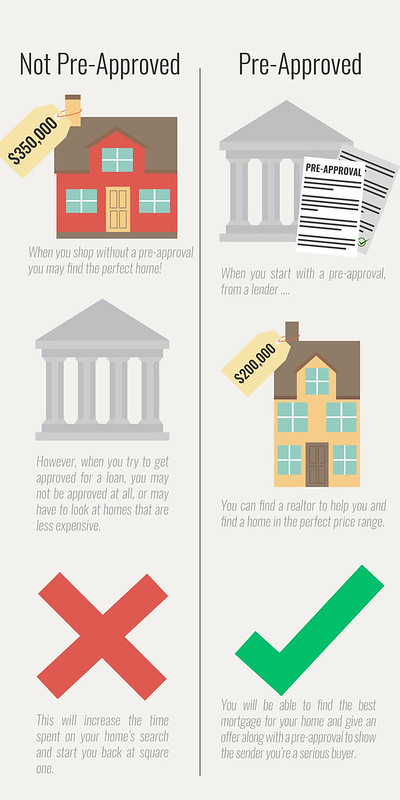

Mortgage Preapproval Cautions

The lender will look at your credit report and history to assess your credit utilization ratio — which is basically the outstanding balances on all your credit cards, and how close they are to your total credit limits. The lower your credit utilization ratio is, the better your chances of getting preapproved for a mortgage. If you are seeking a conventional mortgage, you’ll need a minimum credit score of 620. For a federally insured FHA loan, you’ll need a minimum score of 580 with a down payment of 3.5 percent.

Know When To Get Preapproved For A Mortgage

The down payment required for a house in California can vary depending on the home’s purchase price and the loan type you use to finance the purchase. Generally, conventional loans require a down payment of at least 5% to 20% of the purchase price, while government-backed loans such as FHA loans may require as little as 3.5% down. There are a few first-time homebuyer programs in California that can offer assistance.

Do mortgage pre-approvals affect your credit score?

Katerina Matsa ultimately closed on her first home purchase in late 2018. Looking back, she only now appreciates the critical financial role that her lender played in the home buying process. Even so, Fischer encourages clients to contact more than one lender in order to obtain the best possible interest rate and gain access to different loan options. Ultimately, no matter which lender a buyer uses, a good agent will work to establish a relationship with that lender as part of building a strong team around the buyer.

Mortgages are complex. We break down the basics

The card issuer will perform a hard credit inquiry during the application process, which dives deeper into your credit history. Getting pre-approved for a mortgage should be one of your first steps when buying a house in California. This involves submitting financial documents to the lender, such as tax returns and credit reports. The lender will then use this information to assess your financial situation and determine the maximum loan amount they are willing to offer you. Check out this article to learn more about how to get pre-approved for a mortgage.

"While it's tempting to stretch your budget to afford a home in a competitive market, make sure you're comfortable with the monthly mortgage payments and factor in potential future interest rate increases." The necessary paperwork and verification have already been completed during pre-approval, allowing you to move forward with the mortgage application more efficiently. This speed can help you secure a property before other potential buyers who have not yet obtained pre-approval. Before you apply for a loan, compare rates from at least three to five different mortgage companies to make sure you’re getting the best deal.

Credit Card Issuers That Offer Prequalification or Preapproval

How Long Does It Take to Buy a House? - Realtor.com News

How Long Does It Take to Buy a House?.

Posted: Mon, 27 Nov 2023 08:00:00 GMT [source]

Submit complete and accurate documentation, respond promptly to lender requests, and maintain a good credit profile. If you're considering a substantial move that could change your income or credit status, first consult with your lender to make sure you're not sabotaging your mortgage pre-approval. When you have a pre-approval in hand, avoid making any big decisions like leaving your job to start a business, buying a new car, or co-signing a loan with a family member.

How To Get A Mortgage Preapproval

Most of them are geared toward buyers who earn under a certain threshold of money each year, offering low- and moderate-income individuals a way to buy a home. For example, Redding and La Mesa are two of the cities with options to help buyers manage their upfront expenses. Ultimately, thoughtful preparation and smart timing of your pre-approval application can simplify securing financing and keep you loan-ready without excessive credit checks. Consider getting pre-qualified first to get a rough idea of your purchasing power before pursuing an official pre-approval. Additionally, the pre-approval process helps identify any potential issues with your credit report early on. This gives you a chance to correct errors or work on improving your credit profile before officially applying for the loan.

It’s important to check your credit report before your lender does, in case there are errors that could impact not only whether you get preapproved but also your ability to get the best mortgage rate. To get the best rates and fees, it’s important to shop around before you select a lender for your mortgage preapproval. You may also be required to include the names and contact information of the landlords you’ve had previously. This will help the lender verify that you’ve upheld your financial responsibilities as a tenant.

Your chances of getting approved for a mortgage can increase with a bigger down payment or a low DTI. Switching to an FHA loan or taking time to repair your credit before applying can also make homeownership possible. But generally speaking, you’ll want your debt-to-income ratio to be 50% or lower. Second, the preapproval letter is something you can share with the home’s seller when you make an offer. It shows you won’t have problems getting financed for the amount you’re offering.

Otherwise, such an arrangement could increase your DTI ratio and impact your final loan approval. Additionally, both you and the donor will have to provide bank statements to source the transfer of cash funds from one account to another. If you’re pre-approved for a mortgage, your loan file will eventually transfer to a loan underwriter who will verify your documentation against your mortgage application. The underwriter will also ensure that you meet the borrower guidelines for the specific loan program you’re applying for. A list of all bank and credit union checking and savings accounts with current balance amounts as well as life insurance, stocks, bonds, retirement savings, and mutual fund accounts and corresponding values. You need bank statements and investment account statements to prove that you have funds for the down payment and closing costs, in addition to cash reserves.

In addition to providing the required documents, you'll need to authorize a credit check, allowing the lender to assess your creditworthiness based on factors like your credit score, payment history, and existing debts. It's crucial to ensure that all the information provided is current and accurately reflects your financial situation. Once your application is submitted, the lender will carefully review and evaluate the details provided to determine your eligibility for mortgage pre-approval. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

As one of the largest cities in the United States, Los Angeles offers residents a hub of diverse cultures, lifestyles, and industries. The city is renowned for its beautiful beaches, sunny weather, and endless entertainment options, including world-class dining, shopping, and nightlife. However, living in Los Angeles can also have challenges, including heavy traffic, high living costs, and air pollution. Although Los Angeles is known for its high housing costs, there are affordable Los Angeles suburbs to choose from. You are continuing to a credit union branded third-party website administered by our service provider.

If market conditions have changed since your home pre-approval, you might be able to get a lower interest rate and better loan terms. No, you don't need to use the same lender, unless you've signed a contract. If you get a quote from a new lender that offers more favorable rates and terms, you can certainly work with that lender for your final loan. The pre-approval process can take a few days to a couple of weeks, depending on the lender and your financial circumstances. Mortgage preapproval and mortgage prequalification may be used interchangeably, but there are important differences between the two. If you’re self-employed or own a business, you’ll also be required to provide your tax documents and business returns for the past 1 to 2 years, depending on your lender’s requirements.

As a result, mortgage preapprovals will expire after a certain time period, such as 90 days. Even as a preapproval letter empowers a buyer to move toward a home purchase, it doesn’t limit the buyer’s lending options. Buyers don’t have any obligation to obtain a loan from a lender with whom they have had a conversation, shared financial documents or received a preapproval letter. Now that several large, national mortgage lenders have shifted the preapproval process online, buyers may feel tempted to proceed with the fastest or least-invasive option. Yet, small differences in mortgage lenders can help to avoid regrettable decisions and even secure meaningful savings over the long term. When you are ready to make offers, a seller often wants to see a mortgage pre-approval and, in some cases, proof of funds to show that you’re a serious buyer.

The average cost of homeowners insurance in California is around $1,300 per year, but this can vary based on several factors, such as the value of the property and location. Living in Sacramento offers a rich history, with many museums and landmarks that showcase California’s past. Sacramento is also home to a thriving arts and culture scene, with different music, theater, and festivals throughout the year. The city is located at the confluence of two major rivers, the American and the Sacramento, making it a popular destination for outdoor enthusiasts who enjoy fishing, kayaking, and other water activities. The cost of living in Sacramento is generally lower than in other major cities in California, in fact, Sacramento is 41% less than housing in San Jose.

No comments:

Post a Comment